Health Insurance is the most common benefit offered by employers, and can be quite expensive as well. Most health insurance plans provide comprehensive coverage with relatively low out-of-pocket expense to the employee which can be an attractive benefit to lure and retain quality employees. Robbins Insurance Group can provide insurance plans from numerous health insurance companies. With the health insurance market changing frequently, we are always on the lookout for quality, service-oriented insurance companies for our clients.

Dental Insurance is one of the most requested benefits by employees. Employers who offer health benefits often provide dental insurance for their employees, but a growing number of employers are offering this as a voluntary benefit that is paid 100% by the employee through payroll deductions. Robbins Insurance Group can help you navigate which is best for your company and help you form a plan to offer an effective plan for your workforce.

With 60% of workers requiring corrective eyewear, Vision Care Insurance is very popular and often requested by employees. Many employers offer vision plans on a voluntary basis. The cost of a vision plan is usually an inexpensive add, and the benefits greatly outweigh the cost. Most vision plans are designed with a small co-pay for the exam itself and a co-pay for the materials (frames, lenses, contacts). With low out of pocket costs, it is a plan that employees can easily appreciate.

Group Life Insurance plans can be an attractive offer for your employees. Robbins Insurance Group offers top choices for group life insurance for your workforce.

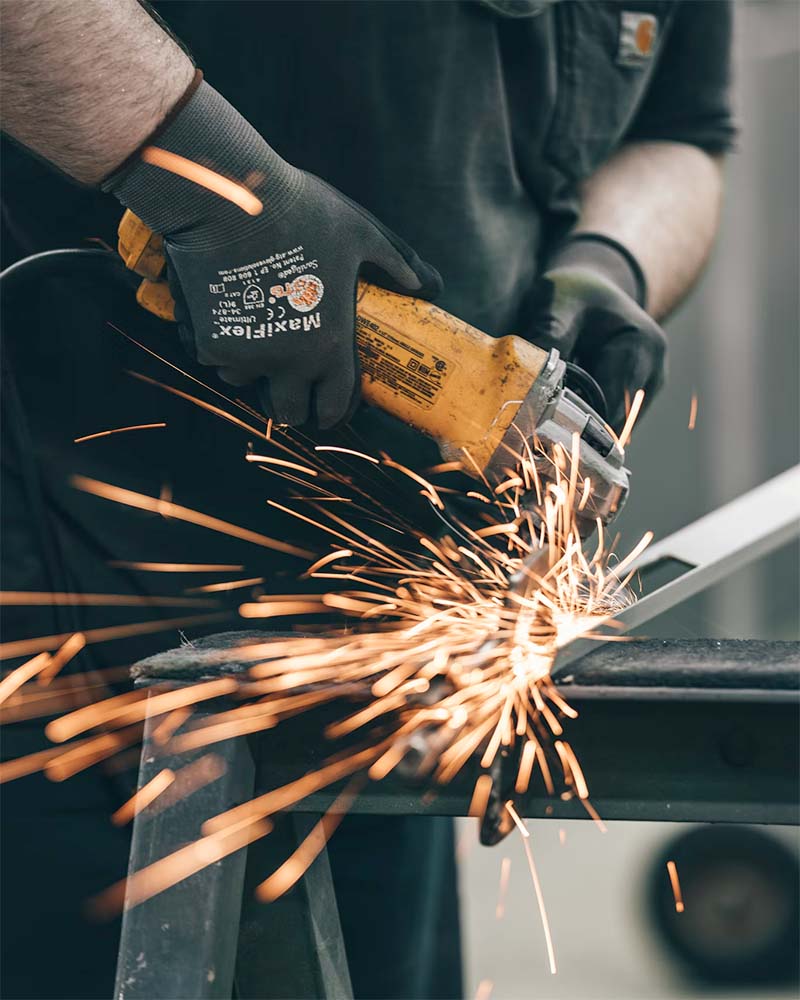

Accident insurance policies help provide support when life’s most unexpected moments arrive. Supplemental accident insurance is meant to be purchased in addition to your primary policy. It helps pay the bills that your major medical insurance doesn’t completely cover.

This helps provide peace of mind when new and unexpected injury costs occur. It works by paying benefits regardless of your current plan. This gives you extra support and financial relief during these covered accidents.

Short Term Disability or "Paycheck Insurance" is a benefit that no one can afford to be without. One can lose significant income by becoming disabled through an injury or sickness. Short Term Disability insurance is a form of insurance that provides a person who becomes disabled with income to cover living expenses, which will continue in spite of the disability. Although an employer cannot afford to pay an employee while he is unable to work, a Short Term Disability Plan is an inexpensive way to ensure that the employee will still be able to maintain an adequate lifestyle during a disabling illness or injury. Let the team at Robbins Insurance Group help you navigate the details of this benefit and find the solution that makes the most sense for your company.

Long Term Disability is similar to Short Term Disability in that it pays benefits to the employee while he is unable to work due to a disability. However, Long Term Disability kicks in usually after the employee has been out-of-work for 3 months or more and can pay for several years, even up until the employees retirement. Robbins Insurance Group and help you understand the details of such a plan and help you select the right offering for you.

Cancer is listed as the #2 cause of death among Americans and the cost of treatment can be staggering making a supplemental policy to help cover the expenses a vital component of an insurance package. Cancer Insurance is a voluntary benefit that few employers think of when designing their benefit package. The benefits of a cancer insurance supplemental policy are paid directly to the patient and are paid in addition to benefits paid by medical insurance or disability plans. Let the Robbins Insurance Group team show you the details.

With a growing need for patients to access healthcare in ways other than a traditional office visit, this industry provides solutions. The Virtual Care, TeleHealth, and Telemedicine industry provides patients with access to healthcare at their fingertips. More and more individuals benefit from virtual care. Those in remote areas, frequent travelers, or individuals facing debilitating mental health conditions rely on telemedicine for care. Ensuring these companies’ longevity is a must, and insurance is one primary path to making that happen.